is that students will in future have to pay tuition fees in England mijenja.Način that are paid for also changes with the extension and revision of student loans.

Current tuition

Currently tuition fees are £ 3,290 per year for all students, depending on universities to attend, and depending on what course they take. This is going to £ 3,375 for students starting in 2011. Pay for this aid are available, depending on family income. For families who earn below £ 25,000 annual grant of £ 2,906 is available, which means only having to pay £ 384 a year in tuition after that. Available support decreases with the increase in family earnings. Those who have an annual income of £ 50,020 are not eligible for support. Once a student grant to consider that often the parents who pay tuition fees on behalf of their children.

How does a student loan now?

All students are eligible for a student loan to pay for their living expenses through sveučilišne.Iznos that can be borrowed depends on each student's personal situation. For those who live in their family home (eg parents) up to £ 3,838 per year is available with £ 4,950 for those who live far from kuće.Kredita is increased for those studying in London. 72% of the above maximum amounts are available to all students, and the remaining 28%, depending on family income.

student loan does not have to be paid back, while former students earning above £ 15,000 a year. After acquiring the repayment amount automatically taken from your salary to 9% of their salary above this amount. So, those earning £ 16,000 will therefore pay 9% of £ 1,000 (£ 90) and those earning £ 30,000 will pay 9% of £ 15,000 (£ 1.350). It then pays the loan repaid. More than that can be paid if the former students want to pay your loan off faster.

tuition fees from 2012

fees will increase significantly. At the beginning of 2012 the university could pay up to £ 9,000 a year, with individual universities will be able to determine how much will be charged. Many have decided to charge £ 9,000 for most or all of their courses.

How will it work?

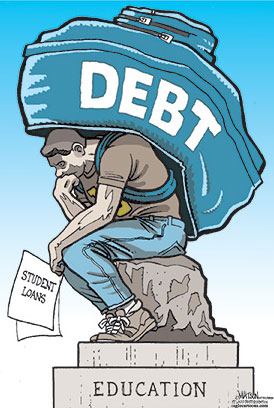

Students and their parents will not be able to pay in advance, something that is currently able to do so. Students must take a student loan to pay for their tuition, and can take over for living expenses beyond that if necessary. There is much controversy and debate over it. Even if the loan is required only for tuition FESS This could add up to £ 27,000 over three years.

This is not quite as bad as many of the media made yet. As repayment is based on later achievement, former students will not have to pay it back, unless they earn a certain amount. If not paid back after 30 years of the loan will be canceled.

Although the amount of student loans will require will be greater than what currently is, the good news is that the threshold increased to £ 21,000. So someone earning £ 30,000 they will pay 9% of £ 9,000 (£ 810), and 9% of £ 15,000. This means that anyone paying off a student loan will be paying less a month than they would under the current system. Former students will be saving £ 540 a year. The downside is that you will be paying for longer.

The University will be worth the cost?

Whether the university will be valuable in the long run ultimately depend on future earnings, something that is difficult to predict. Someone earning £ 30,000 and the repayment of their loans are better than someone earning £ 25,000, with no grade and no credit. So, it depends on the likely increase in salary with a degree in contrast to no one. If a prospective student is looking for employment in the sector where the degree is required or likely to lead to higher wages, then it is likely to be worth the costs.

Should Parents Save for your child the university?

As mentioned above, fees will not be able to be paid in advance. Some parents have complained that they will suddenly have to find £ 9,000 a year, but this is not true with respect to the credit system (with the favorable compared with other loans ).

This does not mean that savings on behalf of children is not a good idea. It's not just tuition fees that students should pay, but the cost of living. And since it can not work, or work part time at best, it can be a burden. This could create a new Junior ISA scheme attractive for roditelje.Junior ISA will allow tax-free savings, where parents will be able to pay up to £ 3,600 per year in the Junior ISA account on behalf of their children. That plus the accumulated interest will then be available for children one to turn eighteen years old when many people start university.

Andrew Marshall (c)